Dear Omm community, following on from our Karma Bond Proposal 2 , we’d like to present a statistics report after a successful second bonding period.

Overall statistics

Unique bonders: 28

Average bonders that held LP tokens before bonding: 53.22%

Average weighted discount: 8.74%

Average weighted percent of acquired OMM sold after claim = 24.83%

Average weighted percent of acquired OMM locked after claim = 14.1%

Note: OMM amount paid out (or claimed) was used as a weight

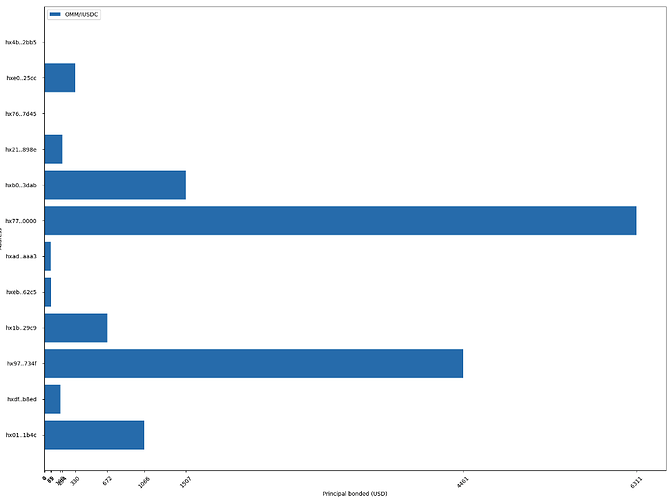

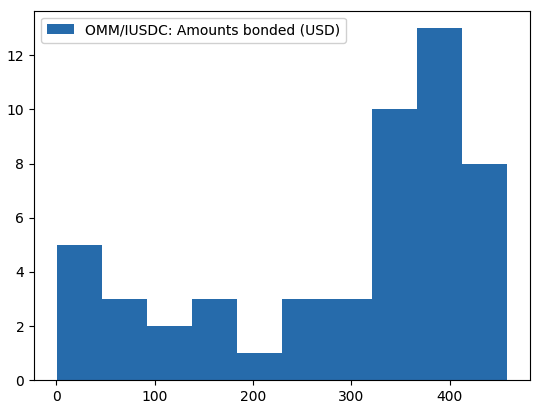

OMM/IUSDC Bond

Bonders holding LP tokens before bonding: 50%

Unique bonders: 12

Average weighted discount: 8.69%

Average bonding amount: $276 (limit was ~$500 per bonding)

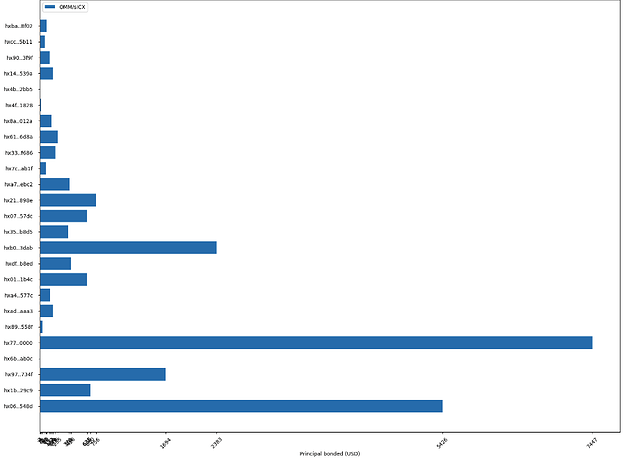

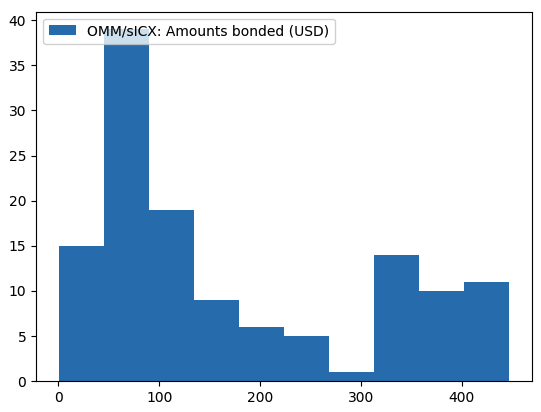

OMM/sICX Bond

Bonders holding LP tokens before bonding: 68%

Unique bonders: 25

Average weighted discount: 8.55%

Average bonding amount: $188.67 (limit was ~$500 per bonding)

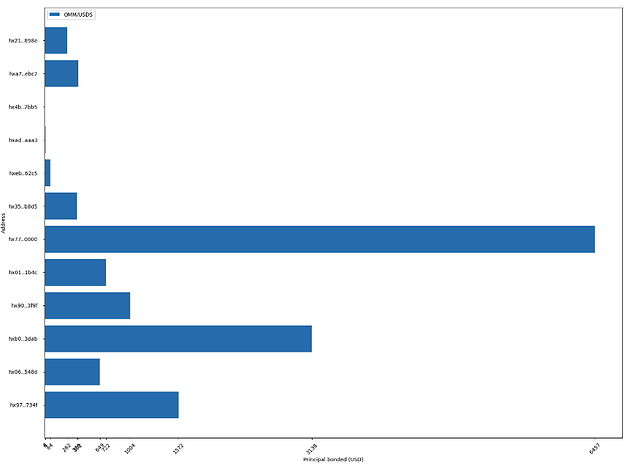

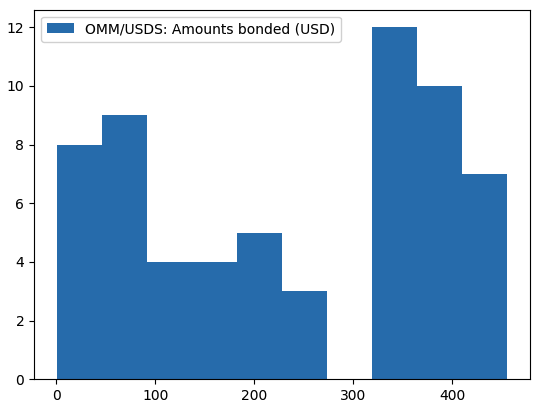

OMM/USDS Bond

Bonders holding LP tokens before bonding: 41.67%

Unique bonders: 12

Average weighted discount: 8.99%

Average bonding amount: $225.39 (limit was ~$500 per bonding)

Summary

The second iteration of bonds provided by OMM has successfully concluded. The average weighted discount was 8.74%, 3.92% higher than the previous round. We consider this a good buy in light of the current market conditions, the holiday season, the longer bonding period and positive OMM movement after claim.

Only estimated 53.22% of bonders held LP before bonding which means 46,78% of newly provided liquidity was put in the pools, stabilizing the price even further.

Estimated 24.83% of acquired OMM was sold with estimation not taking into account OMM held by users before, thus real number could be lower. Approximately 14.1% of OMM was locked within a 4 weeks period after claiming. OMM sold has decreased whilst OMM locked has increased compared to the previous round.