Dear Omm community, following on from our Karma Bond Proposal 1 , we’d like to present a statistics report after a successful first bonding period.

Overall statistics

Unique bonders: 42

Average bonders that held LP tokens before bonding: 40,37%

Average weighted discount: 4.82%

Average weighted percent of acquired OMM sold after claim = 66.28%

Average weighted percent of acquired OMM locked after claim = 4.97%

Note: OMM amount paid out (or claimed) was used as a weight

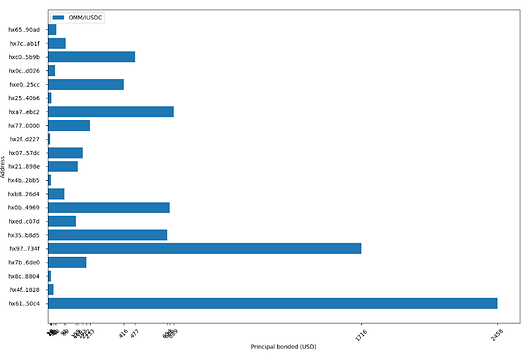

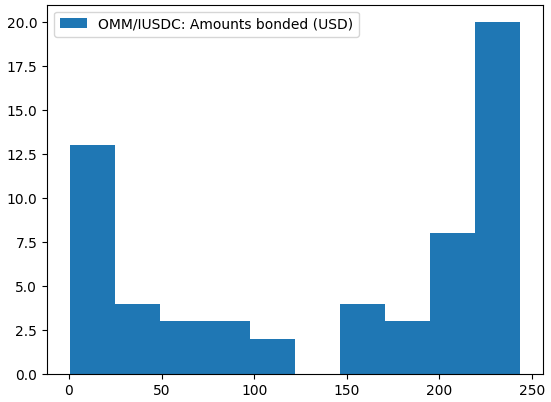

OMM/IUSDC Bond

Bonders holding LP tokens before bonding: 19.05%

Unique bonders: 21

Average weighted discount: 5.15%

Average bonding amount: $129 (limit was ~$225 per bonding)

DIstribution of USD amounts bonded.

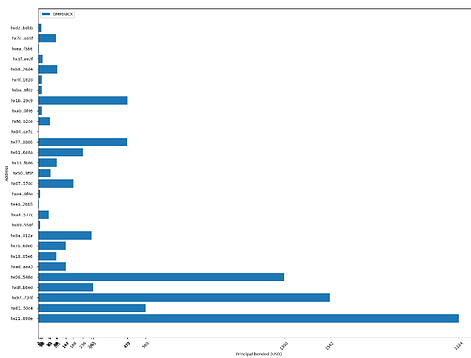

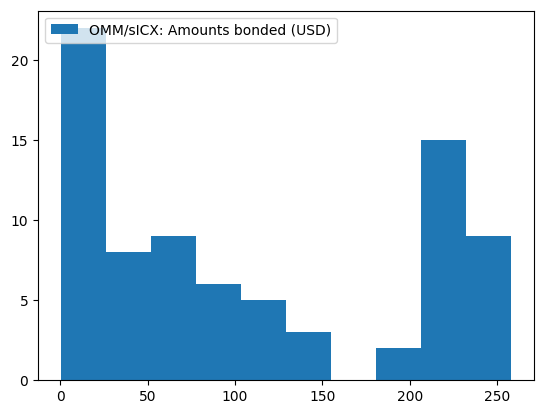

OMM/sICX Bond

Bonders holding LP tokens before bonding: 62.07%

Unique bonders: 29

Average weighted discount: 3.66%

Average bonding amount: $96.68 (limit was ~$225 per bonding)

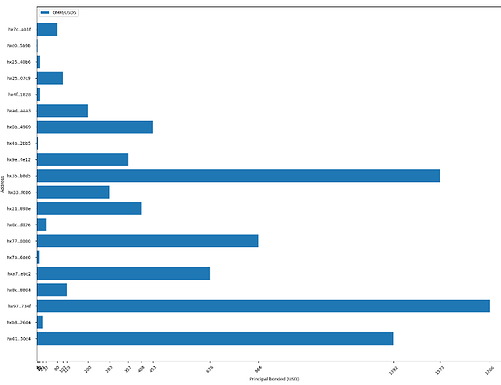

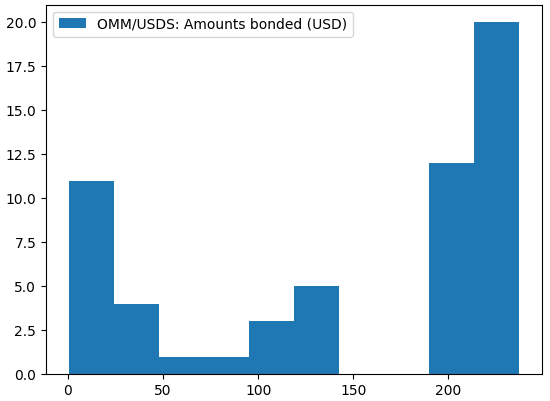

OMM/USDS Bond

Bonders holding LP tokens before bonding: 40.0%

Unique bonders: 20

Average weighted discount: 5.66%

Average bonding amount: $136.01 (limit was ~$225 per bonding)

Summary

The first iteration of bonds provided by OMM was a great success. The average weighted discount was 4.82%, which competes with the Olympus Pro lead bonding protocol (5% average). Because the Icon community and purchasing power are much smaller, we consider this a great success.

Only 40.37% of bonders held LP tokens before which means 59.63% of new users provided liquidity for the first time, providing great educational experience. Newly provided liquidity will help stabilize the price even further.

Estimated 66.28% of acquired OMM was sold with estimation not taking into account OMM held by users before, thus real number could be lower. Approximately 4.97% of OMM was locked within a 4 weeks period after claiming.