As a lender on Omm, I’d like to point out that, for myself personally, I do not need OMM incentives to lend. I understand the benefit to initially bootstrap deposits in order to have funds available to borrow, but at this point I feel that the OMM incentives to lenders are a waste of protocol resources.

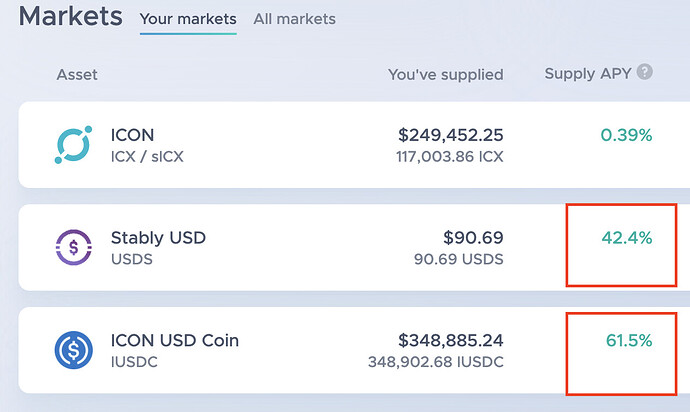

As a lender, I can’t remember the last time I clicked “Rates with OMM”. I just don’t need to, because I scroll down and currently see these extremely high rates. I don’t even care what the OMM rewards are, because 40%+ interest on just my deposits are attractive enough.

Therefore, by moving OMM rewards from lenders to borrowers, I expect the following effects:

Amount borrowed: increase → With more OMM rewards to offset their borrow costs, borrowers will be willing to borrow more and pay higher rates to lenders.

Amount Lent: increase → With an increase in borrow amounts mentioned above, interest rates will increase for lenders, therefore incentivizing more deposits. This is based on the assumption that lenders are not currently lending primarily for the OMM rewards. I shared one data point (myself) where OMM rewards have 0 impact on the amount I am willing to lend.

Additionally, borrowers are what generate revenue for Omm (and for lenders). Lenders enable it, but borrowers generate it. More borrow = more revenue. In banking, a deposit is a liability while money lent out is an asset. It makes more sense to incentivize the activity that generates revenue.

I’ll start this proposal with the following recommendation, but open to discussion of course. Personally, I think that deposit OMM rewards should be set to 0%, but will start with something less aggressive. There’s nothing wrong with gradual change (tho this proposal isn’t necessarily gradual).

Proposal

Across all current markets (including the upcoming bnUSD listing):

Borrow: 75%

Lending: 25%